Stock Market Analysis: Tips for Beginners to Navigate the World of Investments

The inventory market can appear to be a maze of numbers, charts, and jargon, specifically for novices. However, knowing its simple concepts and understanding how to research shares can open up opportunities for monetary growth. This manual will walk you through inventory market evaluation and provide useful recommendations for novices to help you get started on your investing journey.

What Is the Stock Market?

The inventory marketplace is a market wherein customers and dealers trade ownership of public agencies through stocks (or stocks). By making an investment within the inventory marketplace, you purchase a small piece of an organization, and as the enterprise grows, so can your investment.

Primary Market: The place in which agencies issue new shares through initial public services (IPOs).

Secondary Market: Where buyers purchase and sell shares that have already been issued.

The price of stocks rises and falls primarily based on a range of factors, and understanding these can help you make knowledgeable investment choices.

Why Should Beginners Care About the Stock Market?

Investing in the stock market can offer better returns than traditional savings money owed or bonds. While the market does involve dangers, individuals who make investments accurately frequently see large lengthy-time period booms. Beginners can benefit from expertise in how to research the marketplace and individual shares to make smarter decisions.

Potential for High Returns: Historically, the inventory market has furnished higher returns than most other investments over the long term.

Compound Interest: Reinvesting profits out of your investments can lead to exponential growth over time.

Diversification: Stock investing lets you diversify your portfolio throughout sectors, mitigating risks.

How Does the Stock Market Work?

Before diving into analysis, it is critical to understand how the marketplace features.

Stock Prices: The rate of a stock is determined using deliver and call for. If extra human beings need to buy a stock (call for), the charge is going up; if extra humans want to sell (supply), the price is going down.

Stock Exchanges: Stocks are traded on numerous exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ, in which transactions arise.

Market Participants: These consist of retail traders (you), institutional buyers, buyers, and marketplace makers who facilitate buying and promoting.

Types of Stock Market Analysis

There are two essential types of stock market evaluation: Fundamental Analysis and Technical Analysis.

Fundamental Analysis

This approach entails comparing an agency’s economic health and intrinsic fee to decide whether its stock is undervalued or overvalued.

Key Factors in Fundamental Analysis:

Earnings Per Share (EPS): Indicates how profitable a company is on a per-percentage foundation.

Price-to-Earnings Ratio (P/E Ratio): Compares an enterprise’s inventory rate to its income in line with proportion.

Dividends: Some agencies pay out a portion of their earnings to shareholders. Companies with regular dividends may be a sign of monetary balance.

Revenue and Profit Growth: Look at the corporation’s increase over the previous few years to expect destiny overall performance.

Debt Levels: A company with high debt may additionally warfare in a downturn, so compare their debt-to-fairness ratio.

Tip for Beginners: Focus on groups with constant earnings, workable debt, and robust ability for growth.

Technical Analysis

Technical analysis includes reading charge actions and volume on stock charts. This approach is more about the timing of buying and selling than evaluating the intrinsic value of an inventory.

Key Tools in Technical Analysis:

Moving Averages: Averages that help smooth out fee motion to perceive trends.

Support and Resistance Levels: Support is the rate at which a stock tends to forestall falling, and resistance is the level at which the stock tends to prevent rising.

Relative Strength Index (RSI): Measures whether a stock is overbought or oversold.

Tip for Beginners: Technical evaluation may be challenging for beginners. Start by way of gaining knowledge of simple chart patterns and indicators earlier than diving deep into more advanced techniques.

Stock Market Tips for Beginners

Now that you recognize the fundamentals of stock marketplace evaluation, right here are a few pointers that will help you as a newbie investor.

Start with a Solid Foundation

Before making an investment, ensure you understand key standards together with stocks, bonds, ETFs, dividends, and capital profits. There are plenty of free online sources, blogs, and podcasts to help you construct your understanding.

Set Clear Financial Goals

Establish your funding goals—whether that’s a lifetime period increase, saving for retirement, or earning passive income. Knowing your desires will manual your funding method and help you avoid making emotional decisions primarily based on quick-time period market fluctuations.

Diversify Your Portfolio

Don’t put all your money into one stock or quarter. Diversification enables reduced risk. You can diversify across distinctive sectors (technology, healthcare, power) or via making an investment in Exchange-Traded Funds (ETFs) and mutual programs that routinely unfold your money across many shares.

Tip for Beginners: Consider making an investment in low-cost index finances or ETFs in case you’re simply beginning out.

Be Patient and Think Long-Term

The stock market may be unstable, and fees will rise and fall in the short term. However, long-term investors who stay an affected person have a tendency to look for better results. Avoid the temptation to promote stocks at some stage in market dips except there may be a fundamental motive to achieve this.

Tip for Beginners: Avoid frequent trading. Stick to your funding method and assess your portfolio often (quarterly or yearly).

Start Small and Build Over Time

If you’re a newbie, begin with a small funding. The inventory marketplace isn’t a “get rich quick” scheme, and it’s vital to take some time to analyze and gain enjoyment earlier than making sizeable investments.

Tip for Beginners: Open a practice account or use “paper trading” to simulate buying and selling stocks without risking real money.

Avoid Emotional Decision-Making

Emotions can cloud judgment, especially whilst the market is risky. Panic promoting at some stage in a downturn or chasing warm stocks based on hype can result in terrible selections. Stick to your research and strategies, and keep away from knee-jerk reactions.

Tip for Beginners: Create a plan and persist with it. Set clear criteria for when to buy and promote based totally on your desires.

Common Mistakes to Avoid as a Beginner Investor

To assist you keep away from common pitfalls, here are a few mistakes to be privy to:

Chasing Hot Tips: Following random inventory tips from friends, social media, or newsletters can cause poor funding picks.

Failing to Research: Always research before buying an inventory. Don’t depend totally on traits or rumours.

Ignoring Fees: Brokerage commissions, control prices, and buying and selling charges can consume your earnings. Look for low-price investment systems.

Overleveraging: Avoid using too much-borrowed cash to make investments, as it can amplify losses.

Conclusion: Start Your Investment Journey with Confidence

Investing within the inventory marketplace can be a powerful way to build wealth, but it calls for endurance, studies, and a clear strategy. As a beginner, take some time to research the basics, analyze stocks the usage of each essential and technical evaluation, and broaden a different portfolio.

By following these tips and averting commonplace errors, you may set yourself up for a successful investment adventure. Remember, the key to success is staying informed, thinking within lengthy periods, and not being swayed via brief-term marketplace actions.

Disclaimer: This article is for informational functions simplest and does now not constitute an economic recommendation. Always visit an economic advisor before making funding decisions.

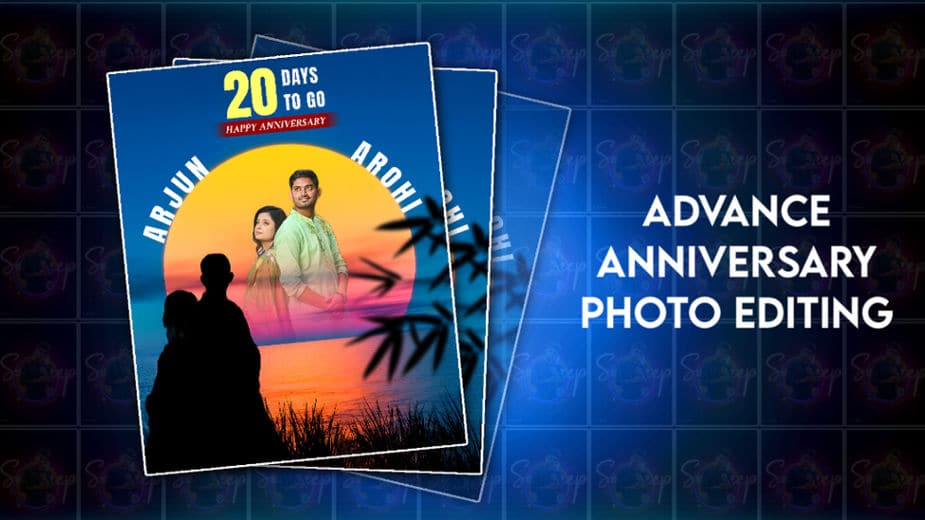

💠Photos Click Here

💠XML Click Here

💠AM Presset Click Here